Compete on Insight. Win on Conviction

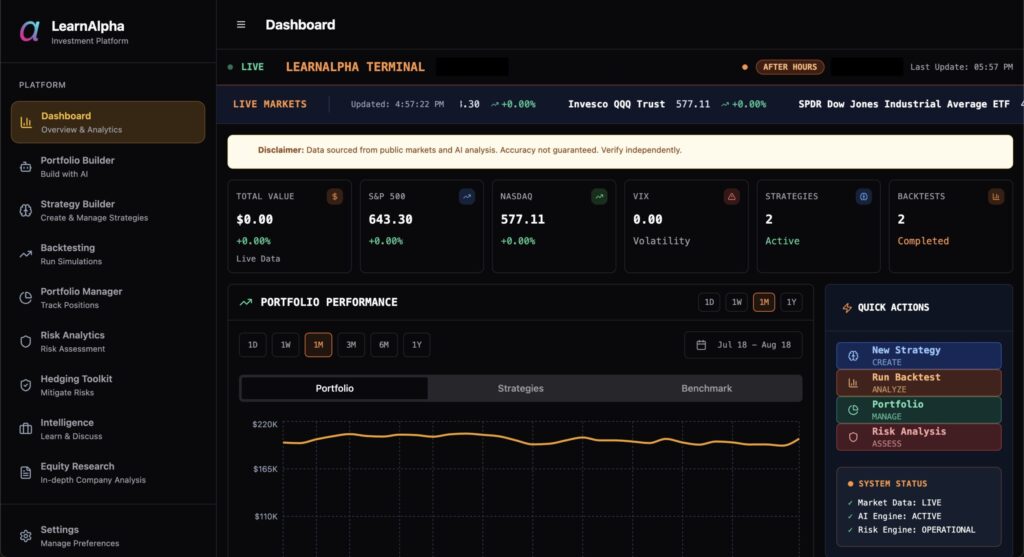

An AI-powered learning terminal for investment clubs

Harness the power of AI and institutional-grade data to transform your investment club into a hands-on learning lab. Build portfolios in a Wall Street-style terminal, run professional simulations, and develop analytical skills in a zero-risk environment. LearnAlpha equips you to generate insights and sharpen the judgment that drives real performance.

Bridge the gap between information and judgment

Investment clubs often stop at surface analysis—ratios, headlines, or generic stock pitches. Meetings lack structure, members disengage, and few graduate with the skills firms demand. LearnAlpha changes that. By harnessing AI and institutional-grade data, it transforms raw information into a disciplined training ground where members practice forming differentiated views and building conviction.

Turn analysis into actionable insight

LearnAlpha gives you the same disciplined workflow that drives professional investment decisions. Build portfolios in an institutional-style terminal, pressure-test ideas without capital at stake, refine strategies through iteration, and prove insights with hard evidence.

Build your portfolio in a Wall Street-grade terminal

Operate in a platform modeled on the tools Wall Street professionals use. LearnAlpha equips you to structure portfolios, analyze exposures, and develop fluency in institutional workflows.

Run institutional simulations without exposure

Train with practice capital in a controlled environment that mirrors professional practice. LearnAlpha facilitates scenario analysis and risk evaluation so you focus on judgment, not speculation.

Refine your strategy

Sharpen conviction through disciplined iteration. Adjust assumptions, conduct sensitivity analysis, and compare outcomes—instilling the rigor expected in professional strategy work.

Prove your insights with backtesting

Validate theses against historical market data. LearnAlpha empowers you to demonstrate whether ideas would have delivered durable results, reinforcing accountability and analytical strength.

Prepare Members to Compete and Succeed

Clubs using LearnAlpha raise the quality of their meetings, sharpen member skills for competitions, and strengthen recruiting preparation. Officers gain structure; members gain the ability to think, present, and defend like professionals.

Unparalleled Educational Growth

Classroom lectures and generic stock simulators leave students with surface knowledge. LearnAlpha bridges theory and practice with structured cases, officer guides, and a terminal that mirrors professional tools. Clubs run disciplined sessions that deliver measurable growth in analytical and presentation skills.

Incisive Insights

Students often stop at ratios and headlines. LearnAlpha trains members to identify signals, construct variant views, and develop recommendations that withstand challenge. The focus is not just on analysis, but on judgment and conviction.

AI & ML-driven Learning

AI can generate answers, but students need to learn to question, refine, and defend against them. LearnAlpha leverages AI and machine learning to create dynamic cases and counterarguments, sharpening students’ ability to push beyond the obvious and defend their own insights.

Preparing the Next Generation of Finance Professionals

Artificial intelligence now performs many of the tasks once central to analyst training—models, comps, and first-draft reports. This shift raises a fundamental question: how do we prepare students not just to use AI, but to demonstrate the judgment, initiative, and critical thinking that employers actually reward?

Read our white paper, which examines evidence from recent finance internship programs and outlines a framework for building the higher-order skills today’s industry demands. It is written for business school faculty, program directors, and investment club leaders who want their students to remain competitive in an AI-driven landscape.

Discover how LearnAlpha.ai accelerates your growth

Your journey mastering the art of creating outsized returns starts here.